What Month Is Best Time To Start With Drawing Money From Rmd

Required Minimum Distributions (RMDs): When to Showtime Planning

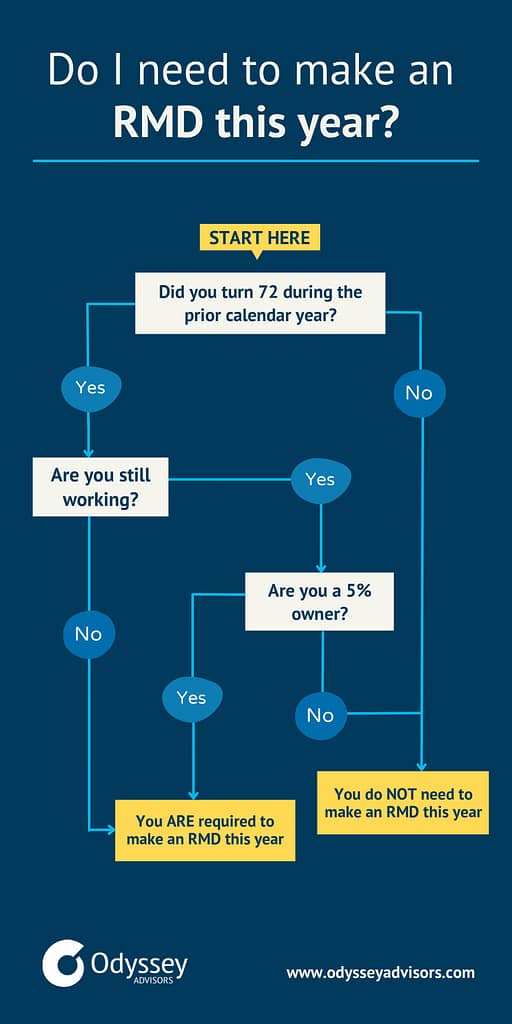

Bottom Line Upward Front You are required to make your showtime required withdrawal from your retirement accounts by Apr 1st of the twelvemonth after you turn 72. After that, you must make 1 every year past December 31st. This is known as Required Minimum Distributions or RMDs. Traditional retirement accounts like a 401(k), IRA, or 403(b) are typically tax-deferred. That means that you don't pay taxes on the money you contribute and y'all don't pay taxes on the money while it sits in the account and grows. Tax deferral, nonetheless, ways simply that. It only delays them until you kickoff withdrawing the funds from your account. And then if you lot don't need the additional income, why non only wait to withdraw as long as possible? Well, Uncle Same won't allow you delay them indefinitely because they're going to want their tax revenue. That's where RMDs come into play. Nether current law, you are required to offset making withdrawals from your retirement accounts by Apr 1st of the year afterwards you turn 72. It used to be 70 ½ before the SECURE Deed. By the way, if you lot like rules, you'll like this handy RMD conclusion tree to assistance you determine if y'all need to make a required minimum distribution this year or not. If you're planning to wait until Apr 1st of the following twelvemonth, go along in mind that you volition be required to accept TWO RMDs in that year. For example, if y'all turned 72 in Dec of 2021, but decide to wait and take your RMD in 2022 past Apr 1st, that RMD volition count towards your 2021 requirement and you will still need to take an RMD for 2022 by December 31st, 2022. RMDs apply to all tax-deferred accounts which include: Roth IRAs are non bailiwick to RMDs because the coin was taxed earlier making a contribution to the account. Basically, Uncle Sam has no incentive to make you lot withdraw from a Roth IRA. That's why you've probably heard of people rolling over their tax-deferred accounts into a Roth IRA, but we'll touch on that more in a bit. If yous don't demand the income from your RMD to cover your retirement expenses, then an RMD may crusade you more headaches. In addition to having to calculate them every year, they could result in excessive and unnecessary taxable income, and if you neglect to withdraw the minimum amount, you'll exist facing a heft fine. Hither is the formula to calculate your RMD: Yous are required to use this calculation to determine your RMD for every retirement account you accept that is subject field to an RMD. The IRS recently released new life expectancy tables for 2022. These tables are used to make up one's mind your RMD. Quick annotation: If you're making your showtime RMD by April 1st, 2022 because yous turned 72 last year, y'all will need to use the previous RMD tables which I will link below. There are two dissimilar sets of distribution factors (or RMD tables). If yous're single OR married and your spouse is not more than 10 years younger, you will utilise the uniform lifetime table. If you lot are married AND your spouse is more than 10 years younger and the sole casher on your account, then. y'all will need to use the joint-life & last survivor table. I'chiliad going to apply the compatible lifetime tabular array considering information technology's more than widely used. If y'all take whatsoever questions regarding the joint-life & last survivor table nosotros'd exist happy to help. Later on a gruesome deep-dive on Google, beyond the outset folio, and by the paid ads, I institute a link to the updated compatible lifetime tabular array for you lot. I also went ahead and put the table downward below so you don't have to scroll the ii miles it takes to find it. Trust me, my fingers are still recovering. Required Minimum Distribution (RMD) table for 2022 Here's a link to the previous IRS uniform lifetime tabular array as promised and to save you lot some PSFP (post-scroll finger pain), hither's a screenshot you can download. And then permit'due south look at an instance: You just turned 75 and you have $150,000 in your IRA. Here'due south what the calculation would look like. If you lot have multiple retirement accounts, y'all will need to calculate each RMD separately for each account. Don't want to practise the math by hand? Here's an RMD calculator you lot can download. Like I mentioned above, if you have multiple retirement accounts, y'all will have to summate the RMD for each account separately. While you accept to calculate each account's RMD separately, in some cases, y'all tin can accept the total RMD amount from one account. If yous take separate IRA accounts, you tin can amass the total amount across accounts and accept that amount from but one of your IRAs. This works with traditional, SEP, and Simple IRAs. For case, let'due south say yous have 3 IRAs and the RMD is $250 for each. You have the selection to either take $250 from each account or accept the total of $750 from one account or a combination of. However, RMD aggregation is non immune beyond employer plans like 401(k)southward and 403(b)s. Short answer, no. If you're married and have separate retirement accounts, you must accept your RMDs separately from each other. Your RMDs cannot come solely from 1 spouse'due south business relationship. If you don't accept your RMD there is a penalty and a hefty ane at that. I recommend setting an almanac reminder merely in example yous don't cease up making a withdrawal or aren't certain if y'all'll meet the minimum requirement throughout the year. The penalty for not making a required minimum distribution is 50% of the amount non taken on time. For instance, if your RMD is $500, but y'all simply take $200, then you will owe Uncle Sam an additional fine of $150 (fifty% of the $300 you didn't withdraw) in addition to the corporeality you all the same owe. Make certain to follow the IRS guidelines and consult your revenue enhancement advisor for more data. Yes, your RMD is considered role of your annual income. The total amount of your withdrawal (or RMD) is taxed as ordinary income based on your income tax rate. You can also take the taxation withheld from your distribution instead of waiting until the cease of the year. Bank check with your retirement account custodian because they should have a form or online procedure when you request your distribution that volition inquire if yous'd like to withhold any corporeality to be sent to the IRS. Yous should also consult your tax counselor as they tin can put together some projections and give you a recommendation on how much to withhold. Remember when I mentioned that you have until the following twelvemonth of your 72nd altogether to take your first RMD? Let's become back to that quickly since nosotros're talking near taxes. If you accept two RMDs your showtime year, it could push you into a higher tax bracket which would mean you'll owe more than in taxes that twelvemonth. Depending on your circumstances, this could also make y'all field of study to the Medicare loftier-income surcharge if your modified adapted gross income is over $91,000 if you're single or $182,000 if you lot're married and filing jointly. And if you receive Social Security, a larger portion could be subject to revenue enhancement. At the take a chance of sounding like a cleaved record, attain out to your financial advisor and tax accountant Before y'all turn 72 so they can help you determine the all-time plan of action based on your particular circumstance. It'due south of import to stay ahead of taxes when it comes to retirement. The sooner you get-go planning the better and here's why… No, I'one thousand not talking nearly the IRS coming after you for their tax money. I want to talk nearly why yous should think about managing your RMD Before you lot hit 72 years former. Like way before. There's this affair called the "RMD Creep" and what I mean by this is that when y'all starting time turn 72 years former, your required minimum distribution will get-go out relatively small, simply as y'all become older your RMD will probable abound exponentially. At that place are two factors that are at play here: The almost common mistake is that retirees will just look at their RMD in the offset few years of the requirement and think that information technology will remain steady. However, the distribution factor changes every bit you go older. The older you get, the lower your distribution cistron is which will increase your required minimum distribution. A higher RMD may force you into a higher tax bracket throughout retirement which can cost more than than about retirees plan for. Yous can avert some of these tax hits if yous program ahead and address these bug earlier on in retirement. That's why it's crucial to develop a tax strategy with your financial counselor and tax accountant in order to avoid costly revenue enhancement surprises downward the road. When you turn 59 ½, yous tin start making withdrawals from your retirement accounts without a penalty. They are even so taxed as regular income, but if you work with your financial advisor or accountant, they can help you figure out how much you can withdraw without moving into a college taxation bracket. Over fourth dimension, the withdrawals will reduce the amount in your tax-deferred accounts which will result in a lower RMD when you reach 72. But once your money is in a Roth IRA, information technology can grow tax-free and withdrawals are nontaxable throughout the residuum of your retirement. They also don't come up with required minimum distributions at age 72. If you don't accept an choice to reduce or avoid your RMD and you don't need it to comprehend expenses, you tin can ever reinvest information technology into a taxable brokerage account. If you make a conversion to a Roth IRA, you can reduce your RMD. If you practise it before you turn 72, you can potentially eliminate your RMD requirement completely. Go along in mind, that the amount y'all convert from your tax-deferred business relationship to a Roth IRA volition exist treated equally income and taxed as such. This may cause your tax bracket for the yr to increase. In one case you hit RMD age you can requite upwards to $100,000 from your IRAs to an eligible charity, taxation-free, every year. This is called Qualified Charitable Distributions (QCDs). A QCD isn't taxable and will count towards satisfying your RMD for the year equally long every bit the organization is considered qualified past the IRS. Equally long equally the organization is qualified, y'all can have your RMD check issued directly to them. There are two rules when making a QCD: You can employ the IRS'due south tool to see if a charity is qualified. Proceed in mind, this is only eligible for IRAs. If you keep to work past the age of 72 and you lot don't own 5% or more of the visitor, you can avoid taking RMDs from the retirement account sponsored by your current employer until you lot retire. Here'southward the caveat, this only applies to your 401(k) at the company y'all're working at. If you have another 401(k) or IRA from a previous employer, you'll need to make an RMD on those accounts. Desire a caveat to the caveat? If your current employer allows rollovers, you tin transfer a 401(grand) from a previous employer into your electric current account. This does not piece of work with IRAs though. No matter when you make up one's mind to take your required minimum distribution and how y'all're going to utilize it – consulting your financial advisor and revenue enhancement auditor well before the age of 72 will give you the all-time options based on your state of affairs. Too, think to take information technology by December 31st (delight set a reminder!) so Uncle Sam doesn't get half of what yous should have withdrawn. Here at Odyssey, we're ever available to help if y'all have any questions. Y'all can reach out to i of our retirement consultants here.

What is a Required Minimum Distribution (RMD and when practise I need to accept one?

How to calculate your Required Minimum Distribution

RMD Table for 2022

Historic period of retiree Distribution cistron Age of retiree Distribution factor 72 27.4 97 7.8 73 26.5 98 7.3 74 25.5 99 6.viii 75 24.6 100 6.4 76 23.7 101 6.0 77 22.9 102 5.six 78 22.0 103 five.2 79 21.ane 104 4.9 lxxx twenty.2 105 4.6 81 19.4 106 iv.3 82 eighteen.5 107 4.1 83 17.vii 108 3.9 84 16.viii 109 three.7 85 16.0 110 3.five 86 15.2 111 3.4 87 14.4 112 3.3 88 thirteen.7 113 three.i 89 12.nine 114 3.0 90 12.two 115 two.9 91 11.v 116 ii.8 92 10.8 117 2.vii 93 10.1 118 2.5 94 9.five 119 2.3 95 viii.ix 120 and older 2.0 96 8.4

How do RMDs work if I accept multiple accounts?

What if my spouse and I have separate retirement accounts? Tin can we combine our RMDs and take them from one account?

What happens if I don't have an RMD?

Are RMDs taxable?

RMD Pitter-patter

Here are five ways to use or minimize your Required Minimum Distributions

1. Manage Your Withdrawals before 72

2. Convert funds from your Traditional IRAs and 401(1000)s to a Roth IRA before 72

3. Reinvest information technology

four. Give it to Charity

v. Go along working

Don't Forget

More Insights From This author

Source: https://www.odysseyadvisors.com/insights/blog/required-minimum-distributions-when-to-start-planning/

Posted by: cappsutonce42.blogspot.com

0 Response to "What Month Is Best Time To Start With Drawing Money From Rmd"

Post a Comment